The landscape of Tiny Houses continues to grow, but many lenders/borrowers are still unsure of what type of loans to offer for interested buyers. There are generally three routes to take:

RV Loan

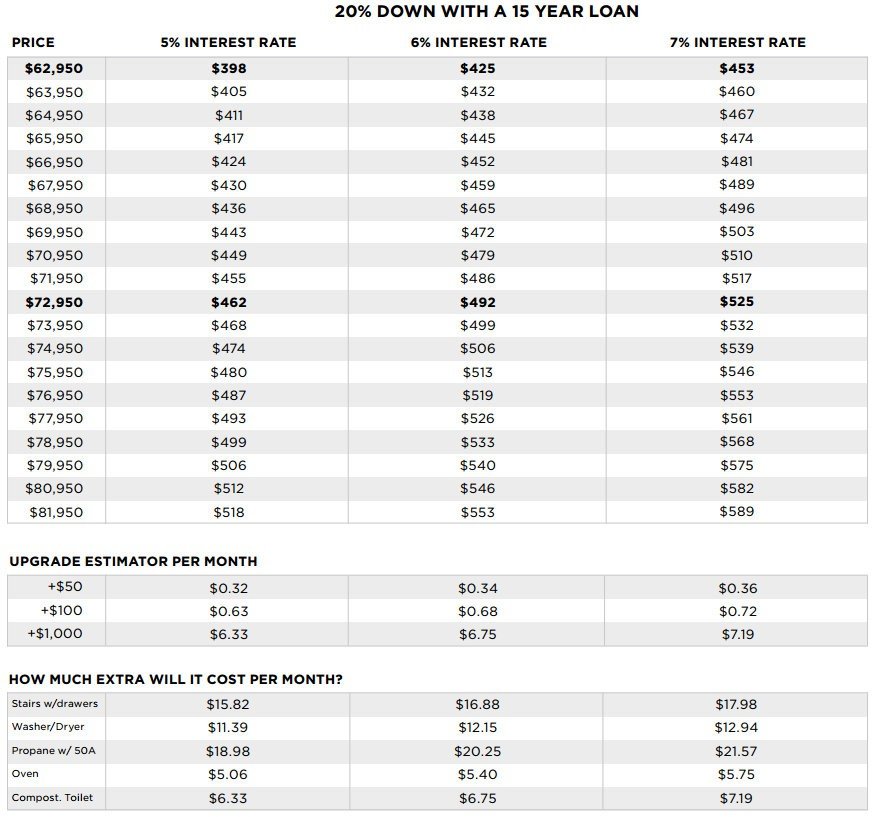

With a Tumbleweed, you get the comfort and ease of knowing your Tiny is RVIA certified. This classification, not only helps insurance groups and zoning ordinances, but it helps banks classify your tiny, in efforts of processing your loan. Many credit unions and regional banks are comfortable financing Tumbleweeds, because of this classification. Rates vary, but these loans usually last you around 10-15 years, and can be as low as $425/monthly.

Many buyers go to their local bank or credit union and get approved to buy a Tiny House RV … But buyer beware on these loans. It isn’t approved until the money is funded. Often these loans get declined in underwriting when someone from the loan department figures out it’s a tiny house.

Unsecured Loan

Depending on the cost of your Tiny, along with your financial/credit history, these loans may be available to you. Although many banks offer these loans, the price of your tiny may limit you to larger banks.

Tiny Home Loans

Several lenders offer loans for “Tiny Houses”. However most are really just unsecured loans with 3-7 year terms. In fact, most Tiny House builders will advertise those lenders on their website.

There are only a few banks that offer a true Tiny House Loan – and usually they require you to go through the builder to get the loan. However, this type of loan is the most reliable form of financing for Tiny House RVs.

Expect terms of 12-23 years with loan origination fees between $1,500 to $4,000. On the flip side the rates are usually pretty good, and these are the easiest loans to qualify for.